Donald’s ‘Trump and Dump’ Scam

Trump screams 'BUY STOCKS!' right before markets surge, but it's just a coincidence, right?

by Bob Cesca

WASHINGTON, DC – It keeps happening. I’m almost certain Donald Trump is exploiting his tariff threats to manipulate the stock market and score windfalls off the subsequent gains and declines. About a month ago I published an article here about the topic, and the events of the last 24 hours absolutely warrant a follow-up. I also published at least two articles about my theory back in 2019 (here and here) during his previous trade war, and I discussed my allegations extensively on my podcast. In fact, I’m fairly certain my listeners grew tired of me going over and over the subject.

On Wednesday, Donald announced on his failing social media app that he would be suspending for 90 days his additional tariffs on Mexico, Canada, and most other nations except for China, which now faces a 125 percent tariff, all of which will ultimately be paid by American consumers. The announcement was short on details and it’s difficult to know which rates still exist, but the upshot was a massive surge in all the major stock indexes. The Dow jumped 2,643 points in the final hours of the day, clawing back some – not all – of its Trump-driven losses.

Almost immediately, experts began to talk about the possibility of market manipulation. Did Donald and his cronies load up on shares prior to the announcement? We don’t know. But if they did, they would’ve made a fortune. Is Donald doing this deliberately? Who knows. To be clear: I don’t have any hard evidence for this theory other than observation, common sense, and Donald’s well-known history of gaming the markets.

But let’s talk about what we know.

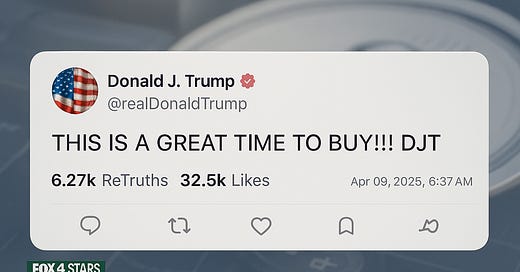

Early Wednesday morning, Donald posted the following message on his failing social media app: “THIS IS A GREAT TIME TO BUY!” He posted other messages around the same time providing context that he was clearly urging his followers to buy stocks. Turns out, it was absolutely a great time to buy and Donald knew it. The tariff announcement dropped several hours later.

Sen. Adam Schiff called for an investigation of what he called “insider trading.” TIME Magazine:

“I’m going to do my best to find out,” Schiff, a California Democrat, tells TIME. “Family meme coins and all the rest of it are not beyond insider trading or enriching themselves. I hope to find out soon.”

During a congressional hearing on Wednesday, Rep. Steven Horsford (D-NV) asked U.S. Trade Representative Jamieson Greer about the tariff reversal, “Is this market manipulation?”

CNBC’s Andrew Ross Sorkin quizzed the acting chairman of the Securities and Exchange Commission about whether there could be market manipulation going on behind the scenes.

“If somebody had access to the list of– the tariff plan the day before the plan and decided to sell out of equities, or to short the market, or to do something else that I haven’t thought about, right? Would that be considered inside information to you?”

If we had a functioning SEC or Department of Justice, there would be investigations and subpoenas issued to determine who in Donald’s inner circle, including his kids, purchased stock during the day on Wednesday based on prior knowledge of the change in the president’s tariff plan. I find it inconceivable that he’d refuse to take advantage of his obvious ability to move the markets, especially given his history of doing exactly that. Once again, the New York Times reported in 2018:

During the 1980s, Donald Trump became notorious for leaking word that he was taking positions in stocks, hinting of a possible takeover, and then either selling on the run-up or trying to extract lucrative concessions from the target company to make him go away. It was a form of stock manipulation with an unsavory label: “greenmailing.” The Times unearthed evidence that Mr. Trump enlisted his father as his greenmailing wingman.

On Jan. 26, 1989, Fred Trump bought 8,600 shares of Time Inc. for $934,854, his tax returns show. Seven days later, Dan Dorfman, a financial columnist known to be chatty with Donald Trump, broke the news that the younger Trump had “taken a sizable stake” in Time. Sure enough, Time’s shares jumped, allowing Fred Trump to make a $41,614 profit in two weeks.

What’s stopping him from doing the same thing now that he’s in possession of the bully pulpit – the ultimate market manipulation platform? Nothing. There aren’t any ethical or legal guardrails. The Supreme Court provided him with immunity for official acts. He’s untethered from the rule of law. So… why not do all the things we’re talking about here?

Make no mistake, the economy isn’t out of the woods yet. Far from it. Investors are selling treasury bonds, which is an indication that investment in the U.S. is weakening. The tariffs on Chinese goods will continue to worsen, driving inflation and the possibility of a deep recession. Donald will keep on waving around his tariff threats as an increasingly toothless cudgel against our trading allies. Market volatility will continue despite Wednesday’s gains. If there’s one thing the markets hate, it’s uncertainty, and Donald’s agenda is anything but certain.

And, most revealingly, Donald Trump is a convicted fraudster. Once a fraudster, always a fraudster. Once a greenmailer, always a greenmailer.

The Banter is 100% independent. We rely entirely on our readers to keep going, so if you would like to support us and our mission, you can get 50% off a membership below:

Read the latest for Banter Members:

Genius title!

Don’t you wonder if “his” SCOTUS Justices also did some well-timed buying and selling? After all, Trump told Roberts, “thank you; I won’t forget what you did for me” after his pseudo SOTU speech…